Social Security

Supreme Court Allows DOGE to Access Social Security Data (6/6/2025)

Doge’s attack on social security causing ‘complete, utter chaos’, staff says (4/6/2025)

EXCLUSIVE: Memo details Trump plan to sabotage the Social Security Administration (3/17/2025)

Cuts to the Social Security Administration Threaten Millions of Americans’ Retirement and Disability Benefits (3/12/2025)

In affidavit, former Social Security official says DOGE is putting benefits at risk (3/10/2025) Caleb Ecarma

The Greatest Threat to Social Security in Its 90-Year History (3/5/2025)

O’Malley: DOGE cuts could soon trigger Social Security system ‘collapse’ (3/3/2025)

Broadcast networks’ evening shows ignored a report showing Trump’s policies would hasten Social Security insolvency (10/22/2024)

What’s the Fate of Social Security in a Brutally Unequal America? (2/1/2024)

The House Republican Study Committee Budget Proposes Harsh Changes to Social Security (9/22/2023)

Should any political party attempt to abolish social security, unemployment insurance, and eliminate labor laws and farm programs, you would not hear of that party again in our political history... There is a tiny splinter group, of course, that believes you can do these things, Among them are H.L.Hunt ..., a few other Texas oil millionaires, and an occasional politician or business man from other areas. Their number is negligible and they are stupid. Dwight Eisenhower

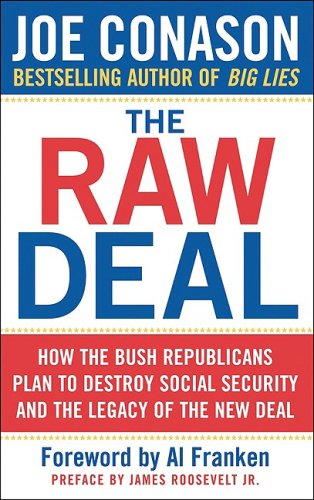

Republicans never liked the New Deal and they have a long history of attempting to roll Social Security back. (scroll down to see some of the attempts over the years.)

Substance over form. Trump has called Social Security a "Ponzi scheme," and in the spirit of making America great again, House Republicans called for sharp cuts in Social Security and dismissed increasing taxes on those who can afford it. https://t.co/8mhT2Mhwe8

— The Washington Spectator | Reporting & Commentary (@WashSpec) July 15, 2024

Trump lies….. pic.twitter.com/JnQVGOICWP

— Annie (@AnnieForTruth) July 19, 2024

Just a reminder that what has driven us into debt is not Social Security and Medicare, but rather the George W. Bush tax cuts and the Trump tax cuts, both of which disproportionately benefited the wealthy and corporations. https://t.co/D98b1PnXYj

— Heather Cox Richardson (TDPR) (@HC_Richardson) June 12, 2024

Rolling back supports for the most vulnerable while passing tax cuts for the wealthy is the sign of a sociopath. That's who Republicans are voting for.

The financial services industry has donated large amounts of money to both Republicans and Democrats, and the one thing that both parties can agree is that they need to fix Social Security. Well funded ( and right wing) ‘think’ tanks like the CATO Institute and the Concord Coalition have been promoting the idea that Social Security is in deep trouble, and that in another thirty years or so, that it will not be able to keep paying full benefits.

The mainstream press never questions that there is a problem.

Projections that Social Security will be in trouble rest on the

premise that the economy will grow at a rate considerably below its

long-term average. Low long-term rates of growth imply a period of

economic decline that would itself be news. At average long-term

growth rates, there is not much of problem and it is certainly not

an emergency. See the article, “Nine Misconceptions about

Social Security” in Atlantic for July 1998.

William Shipman of State Street Bank told the magazine

Pensions & Investments that if privatization were to succeed

“You could be staring at 130 million new accounts” and

it would add millions in custodial fees to the pension assets it

manages. Such a change will certainly benefit bankers and

investment brokers with many millions of new accounts, but there is

little chance that it will function as efficiently or as well as

the present system when you consider the often very large private

salaries, and expenses for sales, telemarketing, and

advertising.

After a severe economic downturn in the 1930’s Social Security was designed as an insurance program, a stimulus for broad-based demand, and a damper for the business cycle. Paul Krugman in Foreign Affairs magazine wrote there is now an eerie similarity in today’s markets to those of 1929. George Soros has written that uncontrolled capital flows act like a wrecking ball that can destroy national economies and possibly render international mechanisms ineffective. The widening distribution of income is also likely to result in a more volatile economy. You may want to go it alone, but a lot of us don’t.

According to the privatizers, the Social Security guarantee would better be converted into a risk based program. Most people are not market savy, and, although investing can be educational, past returns are not assured for the future.

When the politicians say they will ‘fix’ Social Security, keep in mind that all proposals before the Congress will reduce benefits.

Anyway there are already sufficient numbers of ‘private accounts’ like 401K; IRAs, Roth IRAs, Medical Savings Accounts (MSA’s), and others so that adding a new species of account can only further complicate the tax code.

The privatizers ignore other functions of Social Security

including disability payments or survivors benefits.

In June, Rep. Charles Rangel, ranking member of the House Ways and

Means Committee, released a Congressional Research Service (CRS)

analysis on the extent to which three Social Security reform

proposals would reduce defined Social Security benefits:

* a proposal by the National Commission on Retirement Policy, a

panel of Members of Congress and private citizens organized by the

Center for Strategic and International Studies (legislation

recently introduced in the Senate by Senators Judd Gregg, John

Breaux and a few other senators — S. 2313 — and in the

House by Reps. Jim Kolbe, Charles Stenholm, and others — H.R.

4256 — is based on the NCRP proposal); and

* the bill introduced by Senators Daniel Patrick Moynihan and

Robert Kerrey (S. 1792);

* a May 1998 proposal by Robert Ball, commissioner of the Social

Security Administration under Presidents Kennedy, Johnson, and

Nixon and a member of the 1994-1996 Social Security Advisory

Council. According to the CRS, none of the proposed plans will

improve benefits. Over the next 75 years, average Social Security

benefits would be 23 percent lower under the NCRP plan than under

the current benefit structure, 16 percent lower under the

Moynihan-Kerrey plan than under the current benefit structure, and

six percent lower under the Ball plan. (This was posted on the

internet by CRS.)

Right now, SS tax only applies to the first $62,000 , so it is very

regressive. Your Congressman, for example, pays a rate about half

of most working people. Simply removing the cap would eliminate the

problem. So would raising the rate by 1%. These solutions are not

part of the agenda though, and are not up for discussion.

Trudy Lieberman’s (January 27, 1997) article in the Nation

described Social Security privatization … “not so much

a movement as an attempted heist, robbing Americans of perfectly

good social insurance.”

Republicans are still anxious to 'privatize' it.

— QueenofDenial 👸✋ (@AmySimpson6) June 25, 2024

Top 5 Social Security Myths

Myth #1: Social Security is going broke.

Reality: There is no Social Security crisis. By 2023, Social Security will have a $4.6 trillion surplus (yes, trillion with a 'T'). It can pay out all scheduled benefits for the next quarter-century with no changes whatsoever.1 After 2037, it'll still be able to pay out 75% of scheduled benefits—and again, that's without any changes. The program started preparing for the Baby Boomers' retirement decades ago.2 Anyone who insists Social Security is broke probably wants to break it themselves.

Myth #2: We have to raise the retirement age because people are living longer.

Reality: This is a red-herring to trick you into agreeing to benefit cuts. Retirees are living about the same amount of time as they were in the 1930s. The reason average life expectancy is higher is mostly because many fewer people die as children than they did 70 years ago.3 What's more, what gains there have been are distributed very unevenly—since 1972, life expectancy increased by 6.5 years for workers in the top half of the income brackets, but by less than 2 years for those in the bottom half.4 But those intent on cutting Social Security love this argument because raising the retirement age is the same as an across-the-board benefit cut.

Myth #3: Benefit cuts are the only way to fix Social Security.

Reality: Social Security doesn't need to be fixed. But if we want to strengthen it, here's a better way: Make the rich pay their fair share. If the very rich paid taxes on all of their income, Social Security would be sustainable for decades to come.5 Right now, high earners only pay Social Security taxes on the first $106,000 of their income.6 But conservatives insist benefit cuts are the only way because they want to protect the super-rich from paying their fair share.

Myth #4: The Social Security Trust Fund has been raided and is full of IOUs

Reality: Not even close to true. The Social Security Trust Fund isn't full of IOUs, it's full of U.S. Treasury Bonds. And those bonds are backed by the full faith and credit of the United States.7 The reason Social Security holds only treasury bonds is the same reason many Americans do: The federal government has never missed a single interest payment on its debts. President Bush wanted to put Social Security funds in the stock market—which would have been disastrous—but luckily, he failed. So the trillions of dollars in the Social Security Trust Fund, which are separate from the regular budget, are as safe as can be.

Myth #5: Social Security adds to the deficit

Reality: It's not just wrong—it's impossible! By law, Social Security's funds are separate from the budget, and it must pay its own way. That means that Social Security can't add one penny to the deficit.8

Defeating these myths is the first step to stopping Social Security cuts. Can you share this list now?

Thanks for all you do.

–Nita, Duncan, Daniel, Kat, and the rest of the team of moveon.org

Sources:

1."To Deficit Hawks: We the

People Know Best on Social Security," New Deal 2.0, June 14,

2010

https://www.moveon.org/r?r=89703&id=22141-8533824-J7iEN5x&t=4

2. "The Straight Facts on

Social Security," Economic

Opportunity Institute,

September 2009

https://www.moveon.org/r?r=89704&id=22141-8533824-J7iEN5x&t=5

3. "Social Security and the

Age of Retirement," Center for Economic and Policy Research, June

2010

https://www.moveon.org/r?r=89705&id=22141-8533824-J7iEN5x&t=6

4. "More on raising the

retirement age," Washington

Post, July 8, 2010

https://www.moveon.org/r?r=89706&id=22141-8533824-J7iEN5x&t=7

5. "Social Security is

sustainable," Economic and Policy Institute, May 27, 2010

https://www.moveon.org/r?r=89707&id=22141-8533824-J7iEN5x&t=8

6. "Maximum wage

contribution

and the amount for a credit in 2010," Social

Security Administration, April

23, 2010

https://ssa-custhelp.ssa.gov/app/answers/detail/a_id/240

7. "Trust Fund FAQs,"

Social

Security Administration, February 18, 2010

https://www.ssa.gov/OACT/ProgData/fundFAQ.html

8."To Deficit Hawks: We the

People Know Best on Social

Security," New Deal 2.0, June 14, 2010

https://www.moveon.org/r?r=89703&id=22141-8533824-J7iEN5x&t=9

Big Pharma and the Chamber of Commerce are suing to stop the #InflationReductionAct & keep your drug prices high.

— Social Security Works (@SSWorks) August 16, 2023

We're in front of the Chamber with a billboard truck calling them out for their greed.

At noon, we're joining patients to deliver over 150,000 petition signatures. pic.twitter.com/ekpxU1yw8U

"There is huge pressure to turn people into pathological monsters who care only about themselves, who don't have anything to do with anyone else, and who therefore can be very easily ruled and controlled. That's what lies behind the attack on Social Security. And it reflects a deep imperative that runs through the whole doctrinal system." Noam Chomsky: Imperial Ambitions p146

NEVER FORGET: Senator Ron Johnson wants to END Social Security and Medicare. TELL EVERYONE!

— Peter Morley (@morethanmySLE) August 3, 2022

It’s no secret. The GOP has considered several attacks on the “entitlements” we paid into, Soc Security & Medicare.

— Jennifer Bennon (@jennobenno) May 4, 2022

✔️reduced benefits

✔️taxed benefits

✔️privatization

✔️sunset SS & Medicare

Willing to bet they won’t do it?

Protect your retirement. Vote BLUE!#Fresh#wtpBLUE pic.twitter.com/MAAO6iWgh1

To: President Donald J. Trump

You ran on a promise to protect Social Security, Medicare, and Medicaid. And yet your nominees for HHS and OMB have made clear in their confirmation hearings they have no intention of honoring that promise. These men cannot be trusted to protect earned benefits. We demand that you withdraw both nominations and keep your promise to the American people to protect our earned benefits for current and future generations.

National Committee to Preserve Social Security and Medicare

How to Fight the New GOP Scheme To Kill Social Security & Medicare (8/4/2022)

Social Security Administration is preparing to bar 500,000 Americans from getting benefits (12/7/2020)

Is Trump Defunding Social Security and Medicare? Concerns Mount After President's Executive Order (8/9/2020)

Truly Remaking Social Security is the Key to Having a Livable Society in the US (2/16/2020)

Trump administration proposes Social Security rule changes that could cut off thousands of disabled recipients (12/12/2019)

Trump said he wouldn’t cut Medicaid, Social Security, and Medicare. His 2020 budget cuts all 3. (4/12/2019)

On the stump, Trump promised all over the country to protect Social Security. Now he puts a man on the federal bench who said we should abolish Social Security.

— Sherrod Brown (@SenSherrodBrown) March 4, 2020

Even by Trump and McConnell’s low standards, the nomination of Stephen Schwartz is appalling. #TrumpBetraysWorkers pic.twitter.com/5cjriCaXK1

Haley: I am telling you we have to go after Social Security and Medicare. We have to do it pic.twitter.com/KqIG5fMwrS

— Biden-Harris HQ (@BidenHQ) December 9, 2023

" cutting Social Security benefits, rather than raising financial speculation taxes, or other progressive taxes, cannot honestly be called making tough choices. It is making a cowardly choice. It is serving the interests of the rich and powerful at the expense of the vast majority of the population." Dean Baker

Republicans are openly vowing to collapse the entire American economy unless they’re allowed to destroy Social Security and Medicare if they seize power again. pic.twitter.com/qy3rabc2YJ

— Bill Pascrell, Jr. 🇺🇸🇺🇦 (@BillPascrell) October 18, 2022

Here we go...

— 🇸🇪🇪🇺 🌊The Tall Swede 🌊🇪🇺🇸🇪 (@TheTallSwede) July 20, 2019

Took a little longer than expected, but we knew it was coming!#VoteThemOut #GOPThieves

Mitch McConnell Calls for Social Security, Medicare, Medicaid Cuts After Passing Tax Cuts, Massive Defense Spending https://t.co/P7fgAQZEOq

Mitch McConnell says it out loud: Republicans are gunning for Social Security, Medicare and Obamacare next (10/19/2018)

Trump

and Ryan Agree: Let’s Dismantle Social Security (5/16/2016)

Republicans

Against Retirement (8/17/2015)

Jeb Bush on Social Security (6/2015)

GOP

Assault on Social Security Could be 'Death Sentence' for Nation's

Disabled (2/12/2015)

Bernie

Sanders: Raise taxes on the wealthy to save Social Security

(2/10/2015)

The

Terrible GOP Policy That'll Kick Thousands More Mentally Ill Homeless

People Out on the Streets (1/14/2015)

Senator Mike Lee caught ON TAPE saying he wants to "phase out Social Security, pull it up from the roots, get rid of it."

— BrooklynDad_Defiant!☮️ (@mmpadellan) November 3, 2022

Spread this everywhere.

HE NEEDS TO LOSE. pic.twitter.com/wqUVygu7dR

Stop the False War of Words on Seniors Who Need Social Security (12/26/2014)

The Republican war against Social Security (3/17/2014)

Elizabeth

Warren Makes a Brilliant Case For Expanding Social

Security (11/21/2013)

Expand Social Security

Free

Speech and Attacking Social Security

On Social Security’s 88th birthday do not forget that republicans are openly admitting they want to steal your social security and medicare and then force you to work till you drop dead. pic.twitter.com/HAHT2KaCWe

— Bill Pascrell, Jr. 🇺🇸🇺🇦 (@BillPascrell) August 14, 2023

President Obama's National Commission on Fiscal Responsibility and Reform, co-chaired by Alan Simpson and Erskine Bowles, has issued a doomsday report on "fixing" the Social Security retirement system (OASDI) as a part of its proposals to reduce the Federal deficit. This flies in the face of the fact that, not only has Social Security not contributed a dime to the deficit, it has a $2.52 trillion surplus! Amongst other things, the co-chairs would drastically cut retirement benefits and increase the retirement age to 69. Not a single member of this commission, or of the vast TV/audio/print media, has mentioned nor studied other solutions to the alleged Social Security "crisis". John M. Bachar, Jr.

Although the Social Security system (signed into law by FDR on August 14, 1935) initially covered a relatively

small part of the working force, FDR assured his allies it was just the beginning: "I see no reason why everybody in the United States should not be covered," FDR privately told Francis Perkins. "Cradle to the grave – from the cradle to the grave they ought to be in a social insurance system."

But talking about cutting Social Security benefits, rather than raising financial speculation taxes, or other progressive taxes, cannot honestly be called making tough choices. It is making a cowardly choice. It is serving the interests of the rich and powerful at the expense of the vast majority of the population. That may be what politics is about, but it should be described accurately. (Dean Baker)

"The healthcare system...the huge military spending, the very low taxes for the rich [and corporations]...those are fundamental problems that have to be dealt with if there’s going to be anything like successful economic and social development in the United States." As Republican presidential candidate, Texas Gov. Rick Perry, calls Social Security a "Ponzi scheme," and Democrats buy into the narrative that the program is in crisis, to worry about a possible problem 30 years from now, which can incidentally be fixed with a little bit of tampering here and there, as was done in 1983, to worry about that just makes absolutely no sense, unless you’re trying to destroy the program." Noam Chomsky

Why, in God's name, in a tight race, did Barack Obama have a hard time saying six words: 'I will never cut Social Security'? Why won't these Democrats say: 'We will never cut Social Security? ... If they can't say that, how are they ever going to go after Wall Street ? The American people have answers to those questions, he says: "They think it has a lot to do with where campaign money comes from." Senator Bernie Sanders quoted by John Nichols in the Nation Magazine November 2012

CEO's Against

Grandma (11/19/2013)

Take Action:

Defend Social Security, Medicare, and Medicaid

(10/26/2013)

The

President Offers to Cut Social Security and Republicans

Agree (4/10/2013)

A Petition:

We the undersigned strongly object to placing more financial burden on the poor. The proposed chained CPI adjustment to Social Security is a cut to those who need help the most. The federal budget is probably the strongest statement of U.S. priorities that we have. In a democracy, It should reflect the wishes of the people, but, according to polls, it doesn't. Stand strong for Social Security and place the burden on those who can afford it: like Exxon, the most profitable carbon polluter on the planet. Sign here.

Sanders

to Obama: Don't Touch Social Security

(4/5/2013)

Over the last few years, Wall Street has thrown every commission, gang, sequester and supercommitee they could come up with at our Social Security system. Because of your voices, we have beaten them back time and again. It is time to remind them again, hands off our Social Security, Medicare, Medicaid and Veterans' benefits! Michael Phelan Social Security Works

Mandatory

E-Verify Would Overwhelm the Social Security

Administration (9/17/2011)

Rick

Perry, Social Security is a Monstrous Lie

(8/28/2011)

Understand

the Right's Attack on Social Security

(8/28/2011)

Barney

Frank on Social Security, etc. (8/10/2011)

With

AARP Supporting Social Security Benefit Cuts, It's Time To

Burn My AARP Card (6/17/2011)

Word to the Fiscal Commission: Hands Off Social Security (11/10/2010)

Why is it So Acceptable to Lie to Cut Social Security Benefits ? Dean Baker (10/15/2010)

The GOP is the Party Out to Get Social Security

Here are just the most recent attempts of the GOP to effectively destroy Social Security.

- 2005: President Bush launched a major White House initiative, led by none other than Karl Rove, to privatize Social Security. After a massive outcry and campaign by Democrats to stop the GOP plan to privatize Social Security, public disapproval of the president’s handling of the issue rose to 64 percent. The GOP plan was finally abandoned only after the Bush administration’s botched handling of Hurricane Katrina permanently derailed his administration.

- 2010: A ThinkProgress report documented at least 104 Republicans in the last Congress who still wanted to privatize Social Social Security, even after the financial collapse of 2008 underscored how dangerous a move that would be.

- June 2011: Rep. Pete Sessions (R-TX), who leads the House GOP’s election efforts, introduces a new bill to privatize Social Security. Other leading Republicans, including Rep. Jeb Hensarling (R-TX), who would later serve as the GOP co-chair of the Super Committee, take to calling Social Security a “Ponzi scheme.”

- July 2011: Some 229 House Republicans and 46 Senate Republicans vote for a radical budget plan that would result in massive cuts to Social Security (along with Medicare, Medicaid, and anything else the government spends money on).

A Way to Make Social Security Solvent for the Next 75 Years: Senator Sanders. (8/16/2010)

Situation Room Still Scaring on Social Security (8/16/2010)

Hands Off Social Security, There are better ways to cut the National Debt (6/29/2010)

|

Republicans wanted to privatize Social Security and allow you to manage your own money. You still think that is a good idea after the last couple of years of financial meltdown ? Well, guess what. They are still determined to do it.

Looting Social Security (1/5/2010) William Greider, The Nation.

Bibliography

The Truth About Social Security, Nancy AltmanSocial Security: More , Not Less; Robert Eisner

Platinum Plated Pensions:

The People's Pension: The Struggle to Defend Social Security Since Reagan, Eric Laursen

Why are Democrats losing the Social Security Issue ?

Four

Analytical Papers on Preserving and Strengthening Social Security

https://www.thenation.com/doc/20100111/greider

AARP has a link to send a mild message to your senators

https://action.aarp.org/site/Advocacy?id=325&pagename=homepage