Seniors

"Many observers have puzzled over the tendency of Tea Party adherents to favor policies that are often directly counter to their economic interests: Why would a disproportionately older group that is accordingly more dependent on Social Security and Medicare opt for candidates who want to 'reform entitlements?'" Mike Lofgren

Consider the case of the Carlyle Group and the nursing home chain HCR ManorCare. In 2007, Carlyle — a private equity firm now with $373 billion in assets under management - bought HCR ManorCare for a little over $6 billion, most of which was borrowed money that ManorCare, not Carlyle, would have to pay back. As the new owner, Carlyle sold nearly all of ManorCare’s real estate and quickly recovered its initial investment. This meant, however, that ManorCare was forced to pay nearly half a billion dollars a year in rent to occupy buildings it once owned. Carlyle also extracted over $80 million in transaction and advisory fees from the company it had just bought, draining ManorCare of money. ...

Private Equity Is Gutting America — and Getting Away With It (3/28/2023)

Wall Street Is Making House Calls (6/4/2024)

Trump and Elon are killing off Meals on Wheels.

— Rachel Bitecofer 🗽🦆 (@RachelBitecofer) March 30, 2025

No, really. 👇

Agency for older adults and people with disabilities to be shuttered under HHS cutshttps://t.co/reG4FNdlCk

Stop the Medicare “Advantage” Scam Before Medicare is Dead (8/5/2022)

How to Fight the New GOP Scheme To Kill Social Security & Medicare (8/4/2022)

Overdoses, bedsores, broken bones: What happened when a private-equity firm sought to care for society’s most vulnerable (11/25/2018)

‘Too Little Too Late’: Bankruptcy Booms Among Older Americans (8/5/2018)

Nursing Homes Mask Low Staff Levels (7/8/2018)

Trump Is Trying to Preserve Financial Advisers’ Right to Rip Off Clients Saving for Retirement (2/3/2017)

Drinking two glasses of wine a day, keeps premature death away (2/21/2018)

Links

See Healthcare

The SEC website for seniors

Living Longer on Less: A Report by the Institute on Assets and Social Policy

Preventing Aging Unequally

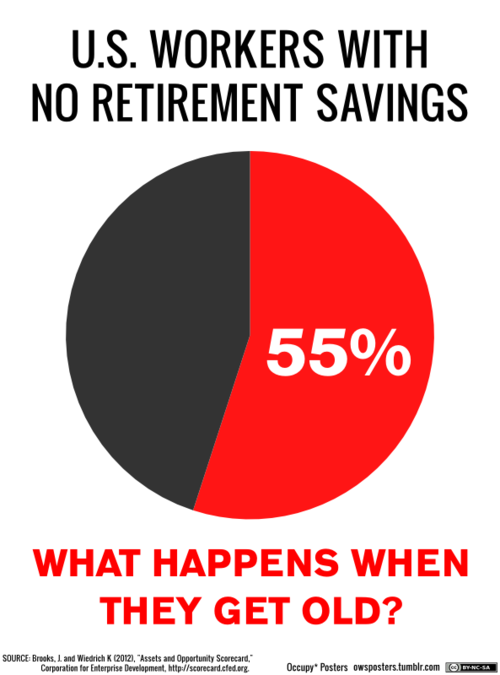

For a long time employer pensions have been disappearing, shifting the burden of retirement on to workers. Many have no retirement savings at all.

Ignoring public opinion, Republicans would remove millions from health insurance so they could save money for what they really want: tax cuts for the wealthy. History shows tax cuts do not pay for themselves. Having failed to cut health care, gifts to the top 1% must be paid directly from deficit spending. When Republicans are in office, as Dick Cheney said: “ deficits don’t matter”.

Among Republican tax ‘reform’ goodies, elimination of the inheritance tax alone would benefit, in billions, Trump $4, Koch $38.6, Waltons $51.6, Adelson 12.2 … and also increase income inequality, create a new aristocracy, and further attack democracy.

Planning for retirement, your hard-earned nest egg must last for the rest of your life, but your financial professional doesn’t have to work on your behalf because the Republican Congress eliminated the fiduciary rule. They may also severely limit the amount you can save in your 401k.

This brings up the question: Does the Congress work on behalf of the people ? Serious academic studies found that it does not: Gilens and Page of Princeton, Lawrence Lessig’s book “Republic Lost” and others* conclude that Congress responds to funders, not people.

Although they found $700 billion to kill people, it appears Republicans are pushing for serious debt to benefit an elite. What kind of country does that ?

" Just look at this statistic: the 100 largest CEO retirement funds are worth a combined $4.9 billion. That’s equal to the entire retirement account savings of 41 percent of American families!" A Tale of Two Retirements (pdf)

I've fought hard for stronger oversight of nursing homes, which have been cutting corners to pad their profits for years. By proposing first-ever staffing standards, @POTUS is showing seniors & workers that he has their back. We must build on this progress.https://t.co/bmCENRYyKW

— Elizabeth Warren (@SenWarren) September 1, 2023

So the Trump administration is now going to ease protections for one of the most vulnerable populations? It is beyond belief how low they will go. https://t.co/d3hI1E6oqE

— Kay Otwell (@OtwellKay) December 2, 2019

2017 Global Retirement Index

Why Long-term Care Insurance Is Becoming a Tougher Call (3/8/2016)

If you are considering Long Term Care insurance, be sure to

see this:

A

Tale of Two Retirements (10/28/2015)

Republicans Against Retirement (8/17/2015)

Most

Households Approaching Retirement Have Low Savings (6/2/2015)

The Plot

Against Pensions

Republican

Threat to Seniors (11/7/2014)

Looting

the Pension Funds (9/26/2013)

Ryan

Selection Sends A Clear Message to Seniors

(8/11/2012)

State

of Connecticut: Aging Services

Consumer Law Project for Elders (CLPE) 1-800-296-1467

ARA

Alliance for Retired Americans

AARP

About the AARP.

With

AARP Supporting Social Security Benefit Cuts, It's Time To Burn My AARP Card (6/17/2011)

Bibliography

Universal Coverage of Long-Term Care in the United States (free ebook)